Cost Table Background and History

The new tables have been under development for the past six years, but the concept was first introduced over 20 years ago. The earliest cost table version was placed in use with CAMA software in 1996 and followed the recommendations contained in the 1995 IAAO Conference presentation “Market-Correlated Stratified Cost Approach” [View Here]

The IAAO presentation outlined weaknesses in the cost approach 20 years ago and suggested improvements. Please read the 1995 paper for background. Figures 5, 6, and 7 showed original ideas for a cost model and Figure 8 referenced hourly labor rate information from Craftsman Book Company. After negotiating the licensing agreement with Marshall & Swift in 1996 I incorporated their unit rates from Section B and Section C of the Residential Cost Handbook (RCH) into the model spreadsheet as illustrated in Figure 5, which became the ProVal cost engine. Please note that the ProVal cost model was never the same as the M&S cost model. For example, M&S sq. ft. rates are applied to the total living area of the home, i.e. the total of first floor and second floor areas added together, whereas the ProVal cost model separately computes first floor and second floor area costs using different sq. ft. rates and then adds them together for the total cost.

In 1996 end user licensing fees were established that were affordable to using jurisdictions, covered licensing costs with M&S, and would avoid the intellectual property and copyright violations that frequently occurred when users simply bought a copy of the M&S books and entered the costs into their computer systems, which could have resulted in embarrassing lawsuits. The original models evolved into using 9 house size price points from 600 to 3200 sq. ft. (Figure 5 of the paper had 7 house price points from 700 to 3600 sq. ft.), which have been used to generate the annual cost tables since then. However, even with the limitations of the original cost model, it performed 3% better as a pure cost engine than did Section A of the M&S RCH, using exactly the same house data (COD of 14.5 vs. 14.9). The same M&S data source was used in both calculations, but the difference resulted from the cost model itself. This was shown by the research reported in Table 2 of the 2006 IAAO Journal article, “Performance Comparison of Automated Valuating Models”. [View Here] The statistical results of the research experiment for a market-correlated stratified cost approach were reported in Table 2 as “TCM”. Twelve appraisal experts from across the country participated in that research. The new Moore Precision Cost residential tables have 25 house price points from 100 to 5000 sq. ft., instead of 9, with more detail and precision calculations than the original models, which contributes to considerably more accuracy of cost estimates in a CAMA environment.

If the end user license fees contained in the original M&S agreement had continued for the past 15 years with reasonable cost of living price increases, jurisdictions would be paying about half of the current annual rates. M&S was an independent company when the 1996 agreement was negotiated, but since then has passed through three new owners ending with its recent acquisition by CoreLogic, Inc. These management changes, combined with their near-monopoly market position, probably explains the current license fees.

J Wayne Moore PHD, LLC was selected to create models to update the 1999 Indiana cost schedules and translate the Craftsman unit-in-place costs for 2012 into the existing Indiana cost schedule format for residential, agricultural, commercial, and industrial real property in a manner that would not require the multiple Indiana software vendors to change their software programming so that they would only need to load the new 2012 tables into their database structures. The old cost model assumptions were found to be outdated. Research was done to modernize the residential cost models and this work laid the foundation for later research and development that resulted in the Moore Precision Cost residential models. Because of Indiana statutory limitations, the commercial models could not be modernized. The new tables were successfully used in all 92 Indiana counties, which had a total of about three million parcels. The new residential cost approach assumptions are explained in “Improving the Cost Approach Value Estimate with New Model Assumptions” [View Here], the feature article in the June 2012 issue of IAAO’s Fair & Equitable magazine. The 2010-2012 Indiana cost table research project laid the groundwork for further research and development. It also led to the establishment of a licensing relationship with Craftsman Book Company similar to the 1996 agreement with M&S, which provided a national construction industry unit-in-place cost data source for Moore Precision Cost.

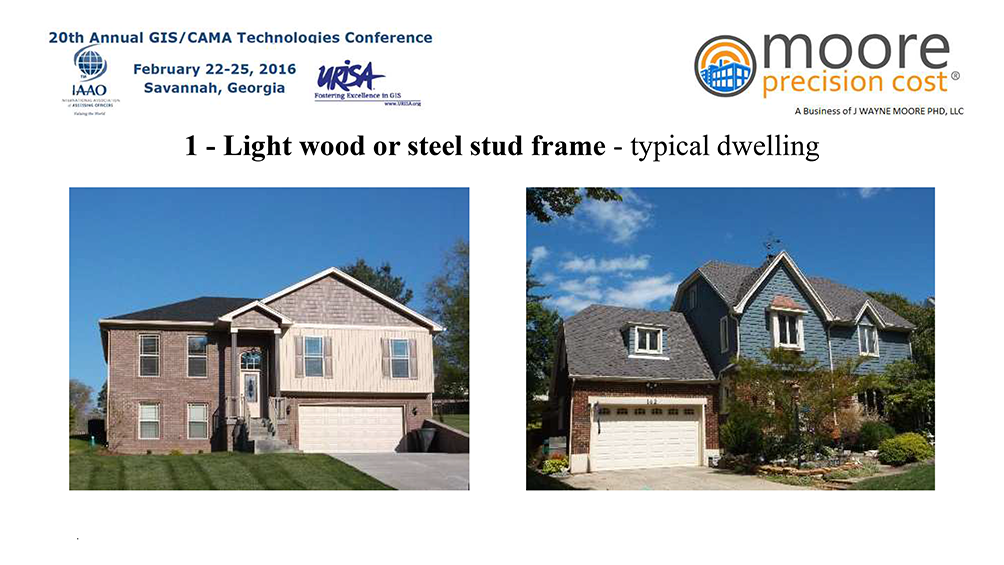

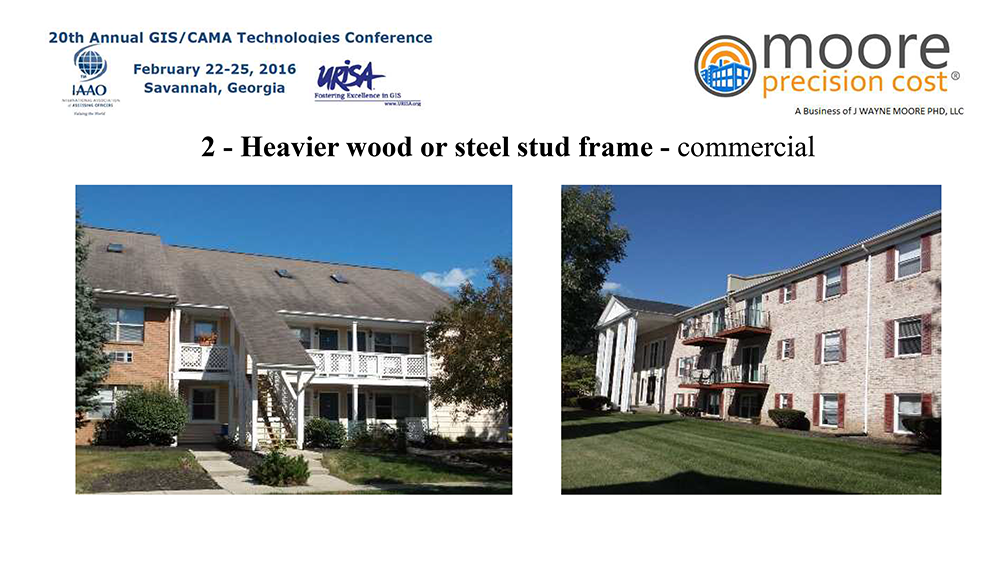

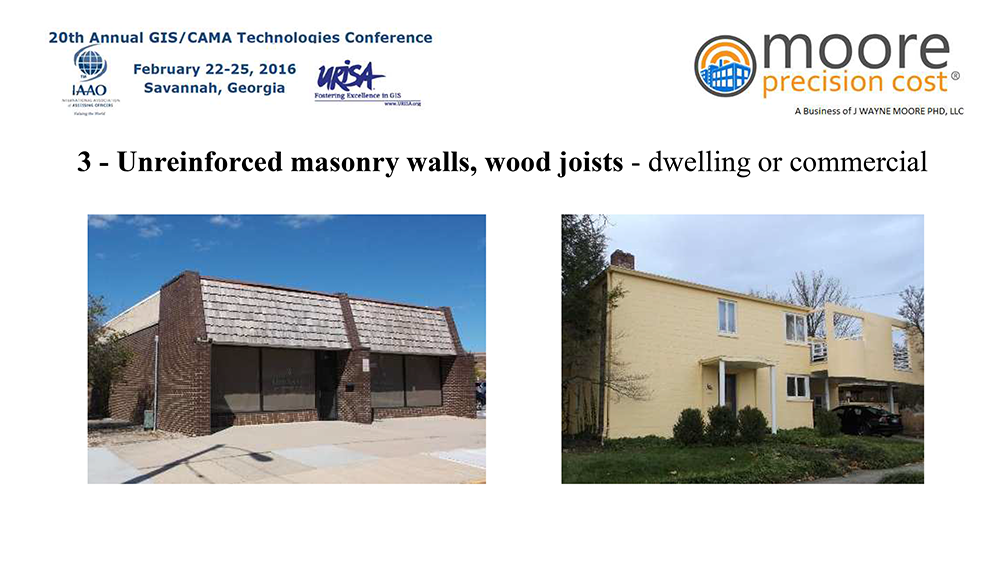

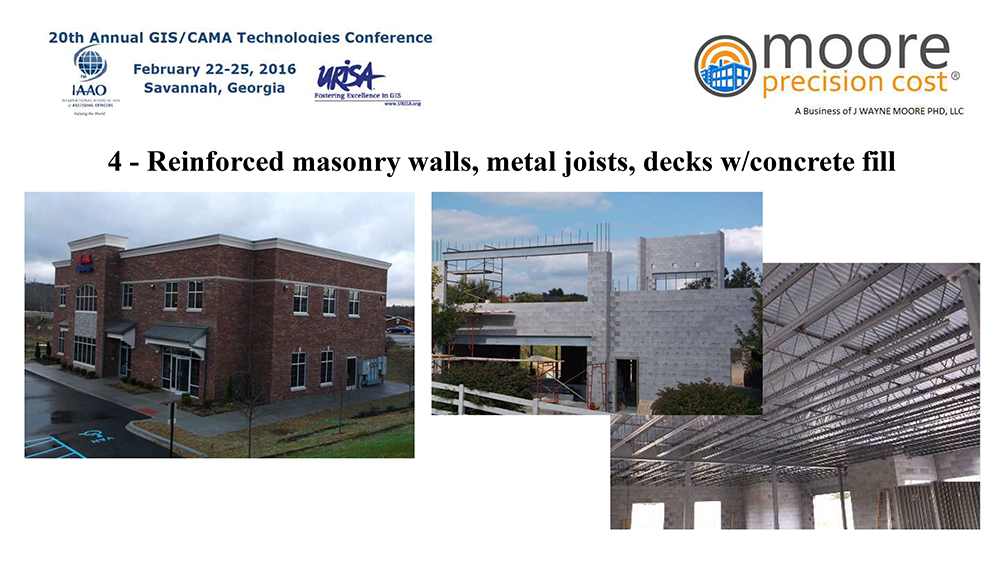

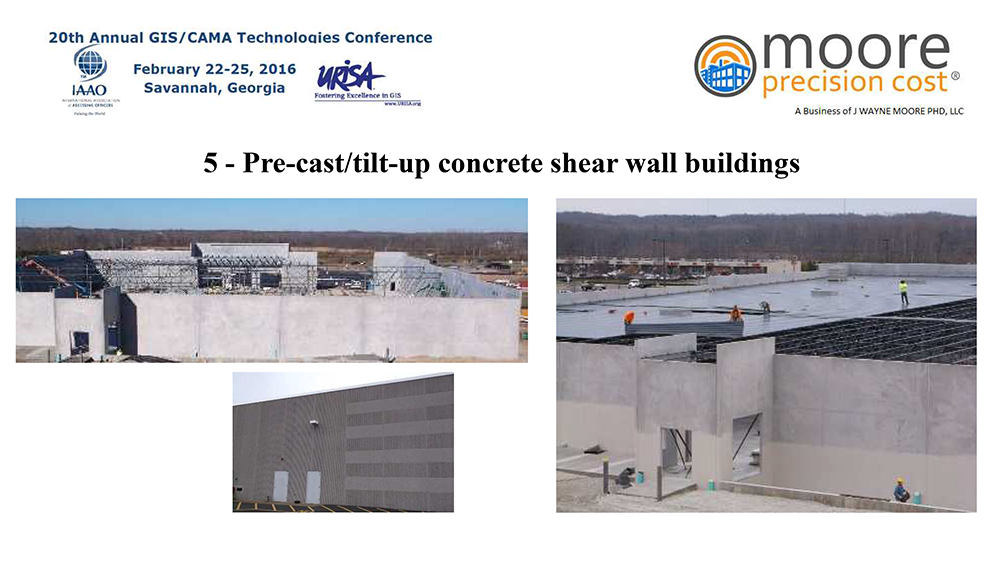

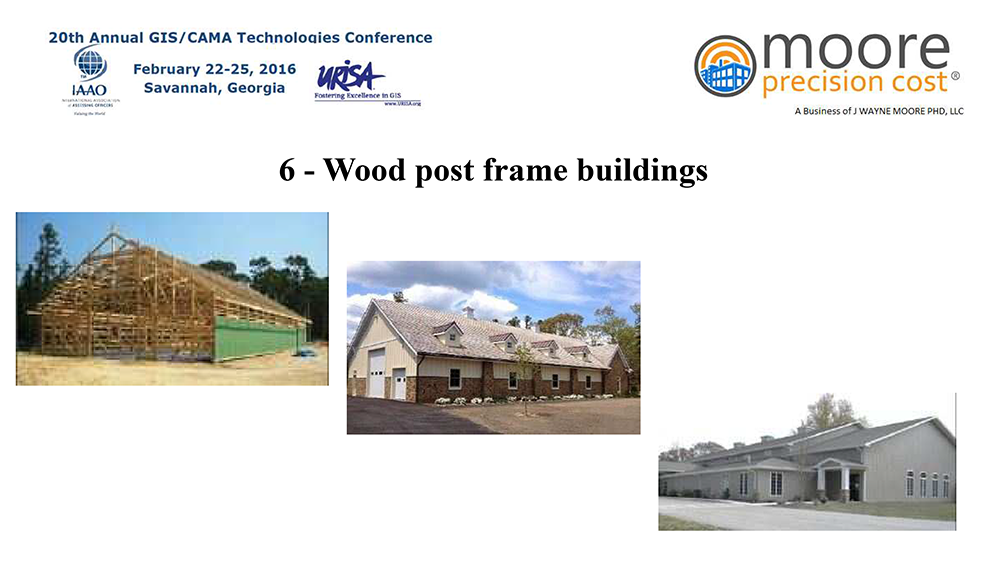

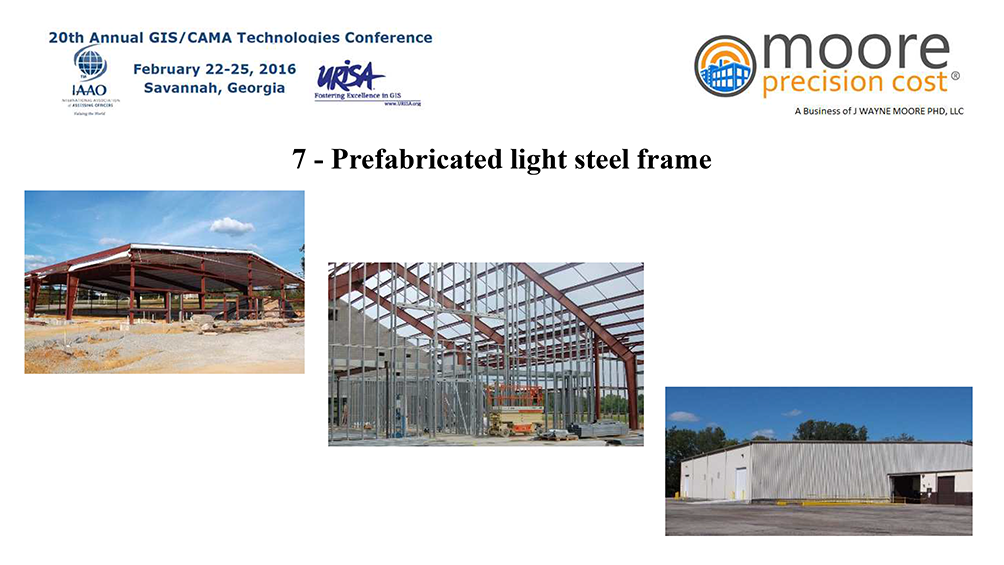

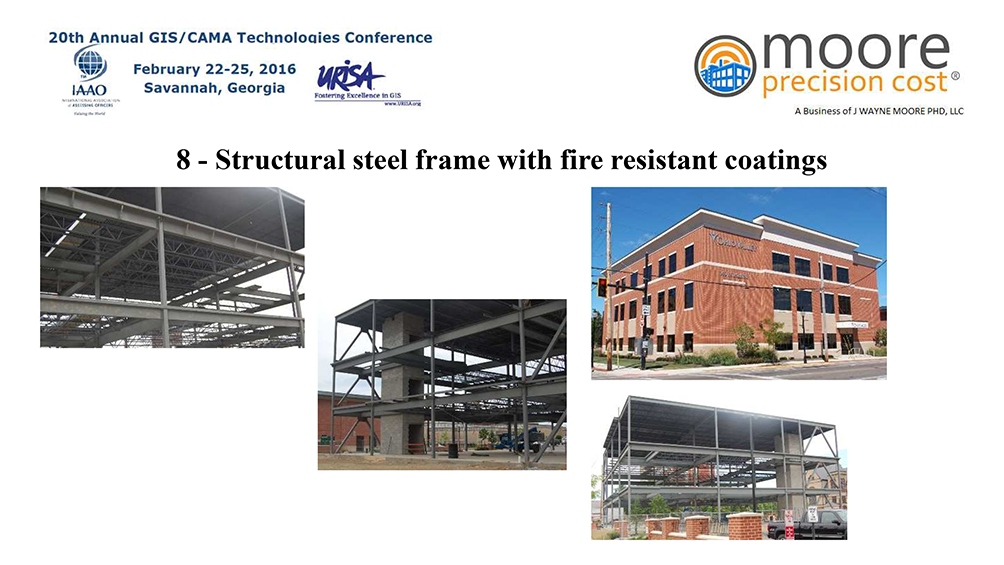

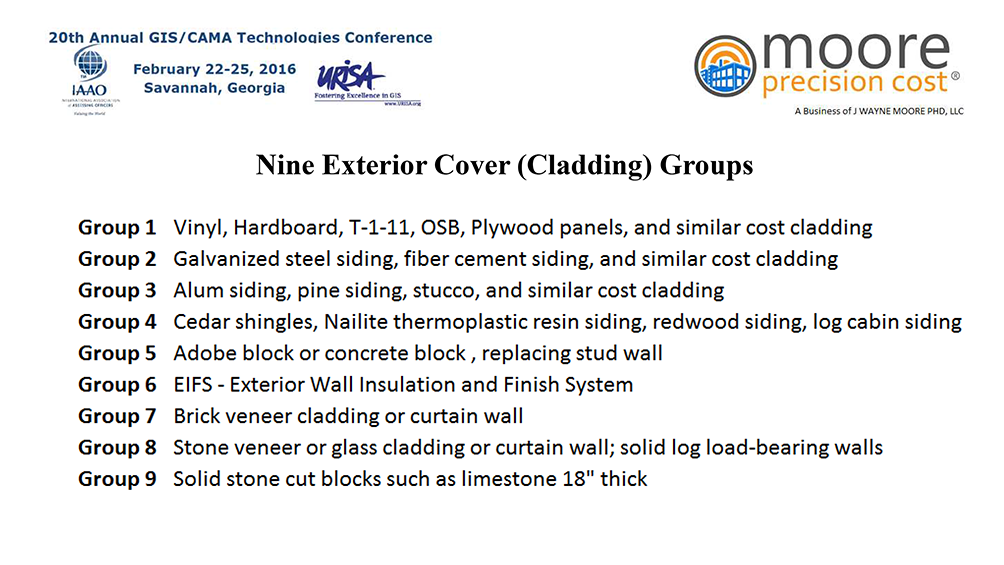

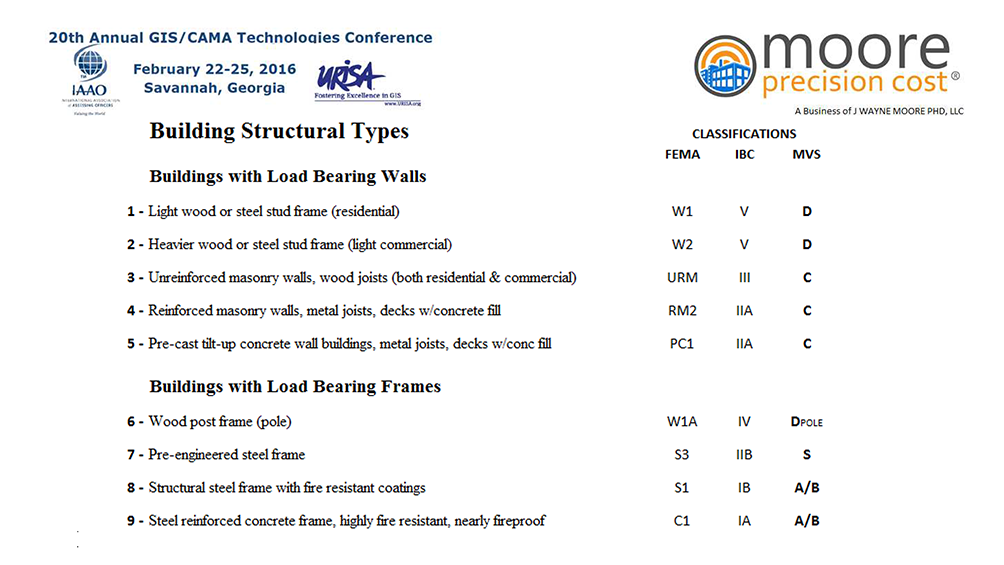

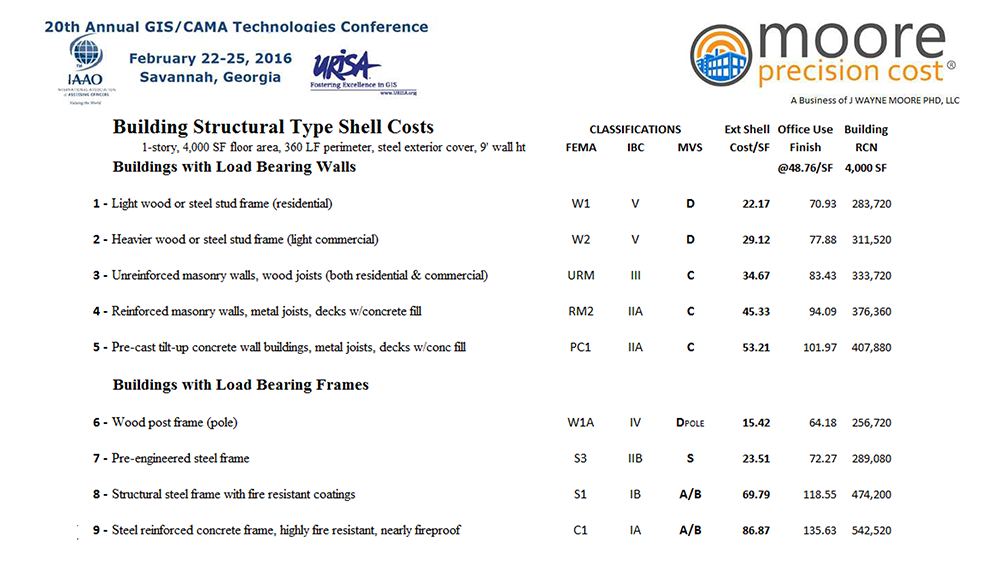

Research began in 2013 to find ways to improve the traditional cost approach used for commercial and industrial buildings, which had always been organized by combustibility classification and occupancy. This type of building type classification may work well for the insurance industry but leaves a lot to be desired for cost approach appraisal work because it does not adequately stratify the various modern types of building structures and begins with building occupancy/use instead of building structure. In 2013 complete building plan sets for all commercial and industrial new construction in the greater Indianapolis area and for the growing area just south of Indianapolis that had been built during the previous 10 years were obtained. The International Building Code (IBC) has been adopted throughout the United States as the core of local building codes. Hence, recent construction in any major metropolitan area can serve as typical for the entire country. These plan sets were studied in detail to learn the characteristics and features of modern commercial and industrial construction. From this research it became obvious that an improved cost approach would need to separate building shell structure costing from the building finish costing needed to satisfy the requirements of numerous uses or occupancies that might be placed in the same basic building structure, and that the finishes might change while the basic building structure would remain unchanged. The research also revealed that many different types of exterior cover or cladding are used with the same basic building structure resulting in considerable differences in cost. These cost differences have not been addressed well by the traditional cost approaches. The new Moore Precision Cost tables have nine building structure type classifications, nine exterior cover cost groupings, and over 200 use finish types that can be placed in any type of building structure. This significantly improves flexibility and precision in cost approach estimates.

Advantages of Moore Precision Cost for CAMA Software Developers

A major advantage of using Moore Precision Cost tables is keeping the entire computational process under your control within your software. The tables are delivered annually in Excel® spreadsheets using a standard format. Guidelines and suggestions will be provided for use of the tables, but software developer still has complete control over how the calculations are done. The tables provide the capability for highly accurate RCN calculations. For example, with 25 stored price points in the residential table for base rates by size, interpolation can be used between the points to obtain a more precise estimated sq. ft. rate for the subject property. An example of the increased precision of Moore Precision Cost is in adjusting the sq. ft. rate for the type of exterior cladding, such as vinyl vs. brick veneer. Many cost systems use a flat rate per sq. ft. for the exterior cladding adjustment irrespective of floor size, whereas Moore Precision Cost is set up for adjustments using different rates for calculation according to floor size. At 400 SF the adjustment rate for brick is $16.45, at 800 SF it is $12.04, at 1200 SF it is $10.43, at 1600 it is $9.33, and at 2400 SF it is $9.10, which recognizes the relationship between exterior wall area and floor area. This example illustrates one of the many ways that Moore Precision Cost achieves more cost estimating precision for residential buildings.

Commercial and Industrial properties

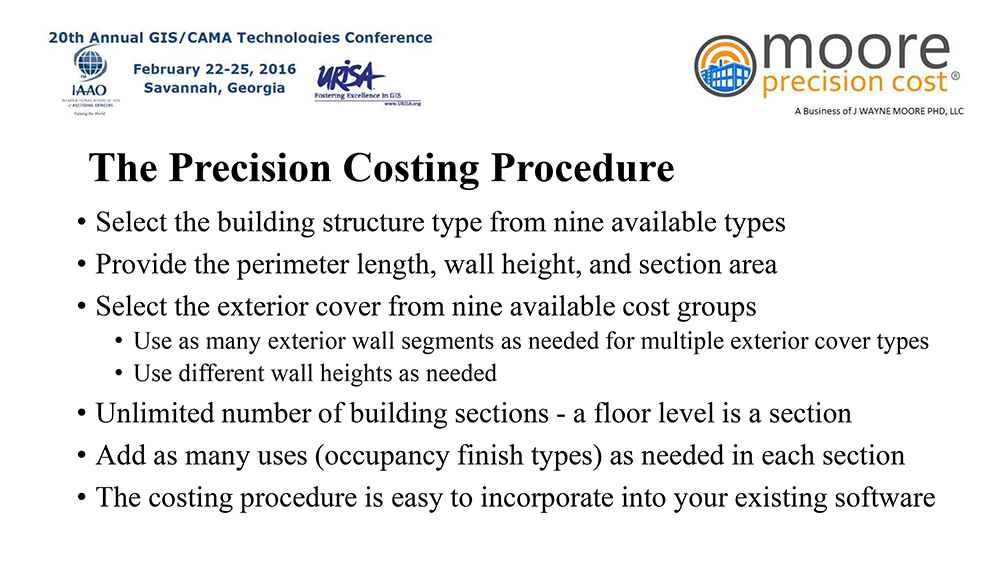

Software changes will be needed to replace the M&S commercial black box if it is being used, or to replace your native commercial and industrial cost calculation procedures because the Moore Precision Cost calculation is new and unique. The calculation uses the same data typically collected for commercial and industrial properties including perimeter wall linear feet, floor area, wall type, wall height, and framing type. These characteristics are used in precise cost calculations for the building structural shell exterior wall, floor, and roof assemblies based upon nine different standard building structure types, producing the building structural shell cost that can have many different uses. The exterior wall can have an unlimited number of segments with differing wall heights and exterior cladding. The calculation process needed in the software is straightforward and easy to program. The complexity of the process is contained within the Moore Precision Cost model that generates the unit cost rates that are in the tables that the software uses for the computation.

As you transition to using Moore Precision Cost for commercial and industrial properties with its greater precision for these property types, you will need to work out an acceptable result display format because your software actually controls the display presentation, rather than being controlled by the tables that are used for doing the computations.

An actual 52,286 sq. ft. light manufacturing building completed south of Indianapolis in 2014 will be used to illustrate the cost computation. The building sketch is below in Figure 1. It has four different wall heights and interior use finishes for manufacturing and industrial office. The computational results are shown on the next page.

Figure 1. Actual light manufacturing building completed in 2014 south of Indianapolis

Industrial Building Description

Building structure type = 7 Pre-engineered steel frame

Total perimeter = 986 LF

Perimeter wall sections:

- 666 LF of 28’ wall height

- 110 LF of 15’ wall height

- 100 LF of 12’ wall height

- 110 LF of 9’ wall height

- All with steel exterior cladding

Uses (finish):

- Industrial office area (INDOFF) = 1508 sq. ft.

- Light manufacturing area (LMFG) = 50,778 sq. ft.

The computational results are shown below in Figure 2 with the building shell structure calculations on the left and the use finish calculations on the right.

| Building Shell Structure Calculation |

|

|

Use Finish Calculations |

|

| First Floor Level – Section 1 (2014) |

|

|

Primary Use Code |

LMFG |

| Building Structure Type |

7 |

|

Primary use area |

50,778 |

| Total floor perimeter |

986 |

|

Use area cost per SF |

25.36 |

| Total floor sq. ft. area |

52,286 |

|

Use area cost |

1,287,730

|

| 1st perimeter wall section length |

666 |

|

Primary Use other cost |

14,990 |

| 1st perimeter wall section height |

28 |

|

Use flat costs [FIRST FLOOR ONLY] |

4,300 |

| 1st perimeter wall code |

Steel |

|

Primary Use area cost |

1,307,020 |

| WH rate |

91.62 |

|

|

|

| 1st perimeter wall section cost – 666 LF |

61,020 |

|

Second Use Code |

INDOFF |

| 2nd perimeter wall section length |

110 |

|

Second use area |

1,508 |

| 2nd perimeter wall section height |

15 |

|

Use area cost per SF |

41.91 |

| 2nd perimeter wall code |

Steel |

|

Second Use area cost |

63,200 |

|

WH rate

|

65.36

|

|

|

|

|

2nd perimeter wall section cost – 110LF

|

7,190

|

|

3rd use, 4th use, etc. |

|

| 3rd perimeter wall section length |

100

|

|

|

|

| 3rd perimeter wall section height |

12

|

|

Total cost of all interior use finish areas |

1,370,220

|

|

3rd perimeter wall code

|

Steel

|

|

|

|

|

WH rate

|

59.30

|

|

|

|

|

3rd perimeter wall section cost – 100LF

|

5,930

|

|

|

|

| 4th perimeter wall section length |

110

|

|

|

|

| 4th perimeter wall section height |

9

|

|

|

|

|

4th perimeter wall code

|

Steel

|

|

|

|

|

WH rate

|

53.24

|

|

|

|

|

4th perimeter wall section cost – 110LF

|

5,860

|

|

|

|

| 5th, etc. perimeter wall sections |

|

|

|

|

|

(total of wall sections = floor perimeter) |

|

|

|

|

| Building Structure Type |

7

|

|

|

|

| Horizontal costs |

372,800

|

|

|

|

| Frame cost |

486,260

|

|

|

|

| First floor section 1 building shell cost |

939,060

|

|

TOTAL Building First Floor Section 1 Cost |

2,309,280

|

Figure 2. Actual light manufacturing building cost calculations

This example illustrates the cost approach results that your software should obtain using Moore Precision Cost tables. The software should store the computational results in appropriate detail to allow depreciation to be applied separately to the building structural shell and the defined use areas for each building section and floor, keeping in mind that you should allow for an unlimited number of building sections, perimeter wall segments with different wall heights and cladding in each section, and an unlimited number of defined use areas in each section.

Depreciation Tables

The base depreciation tables are included with the Moore Precision Cost tables. These depreciation tables are generic and intended as a starting point. As is always recommended, depreciation tables need to be reviewed, analyzed, and adjusted according to the needs of each assessing jurisdiction. The methods used for RCN calculation in the new cost tables for commercial and industrial buildings allows the vendor software to store the computed results separately for the building shell structure as well as the multiple interior use finishes within the building. This allows for separate depreciation schedules to be applied to the building shell structure as well as the multiple interior use finishes if the vendor has this capability in the software. This also allows interior use finish depreciation to be revised when use areas are renovated or completely replaced with new uses.

Yard Items, Special Features, and Outbuildings

The Moore Precision Cost tables have everything necessary to handle the yard items, special features, and outbuildings.

Location/Area Modification Factors/Multipliers

All evidence from recent research has indicated that the published location modifiers from Craftsman, Marshall & Swift, and R.S. Means are of little value in fine tuning the final cost estimate. Additionally, the cost estimates from all three national publishers were discovered to be consistently higher than the actual local construction costs, at least in the central portion of the United States. This was discussed in the 2012 Fair & Equitable article. This problem must be resolved within each local jurisdiction by performing an analysis to compare cost schedule computed results with actual known new construction costs in the specific jurisdiction. The required analysis is simple and produces an adjustment factor called the verified economic modifier (VEM), which is explained briefly in the same attached F&E article. For these reasons location modification multipliers are not included with the Moore Precision Cost tables.